Huawei will soon ship its Ascend 910C AI chip to customers in China as early as next month. The chip pairs two 910 B processors in one package to double its power and memory capacity. Parts of the chip are made by the Chinese firm SMIC using a seven-nanometer process, while some use chips made by TSMC for Sophgo. U S rules now require Nvidia to get a license to sell its H20 chip in China, and this move gives Chinese firms a homegrown option. Huawei shared samples of the 910C with technology firms and has already taken orders ahead of mass production.

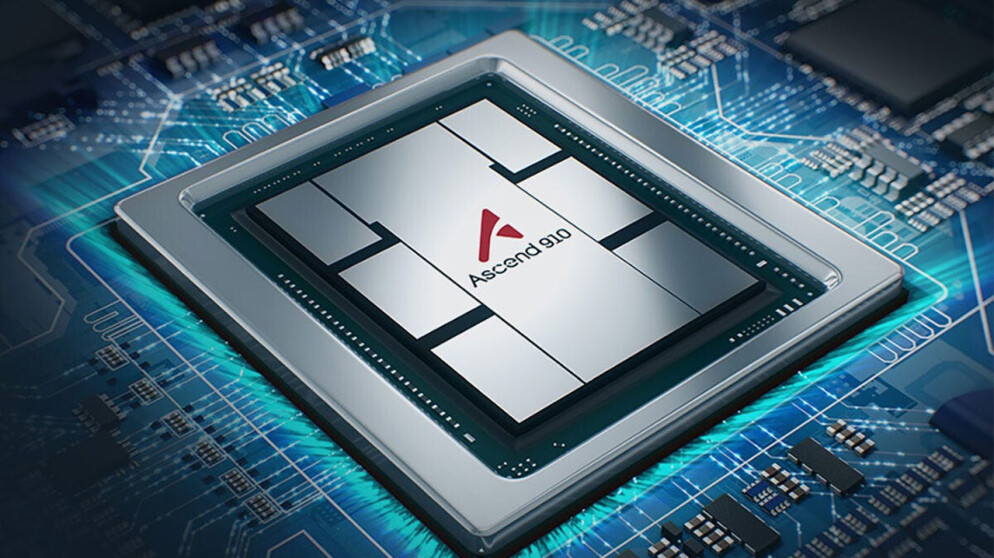

The Ascend 910C Chip

The Ascend 910C builds on Huawei’s earlier 910 B processor by joining two 910 B chips in one package. This design doubles the compute speed and memory for AI work. One insider said the chip has gains in handling different kinds of AI data. It aims to match the performance of Nvidia’s H100 chip for running AI applications.

Manufacturing and Partners

Huawei uses SMIC to make many of its 910C chips on a seven-nanometer process. SMIC’s yield rates are low, which limits the number of chips produced in each batch. Some 910C units use chipsets built by TSMC for Sophgo under a separate deal, Reuters. The U.S. Commerce Department is checking TSMC’s work after finding one of its chips in a 910 B processor.

Performance and Comparison

The 910C delivers strong inference power for AI tasks that make models give answers. In one test, it reached about six tenths of the H100’s speed for running models. Huawei also showed a supernode system that links 384 of the chips to reach three hundred petaflops of compute. This beats the raw power of Nvidia’s GB200 NVL72 machine but uses more energy.

Industry Context

China’s strict new rules mean Nvidia must get a licence to send its top AI chips into the country. This opened a gap for Huawei and other local chip makers like Moore Threads and Iluvatar CoreX to step in. Many AI firms in China now see the Ascend 910C as a strong option for their projects.

Impact on China’s AI Race

The 910C will help Chinese AI teams keep building products without foreign limits. This move pushes China toward a goal of making its own top chips at home. It also shows how U S controls can spur local innovation when access to imports is cut.

Huawei aims to start full production soon and ship the chips across China. As yields improve, the chip could see wider use in data centres and research labs. This development marks a step toward China’s plan to build its own AI ecosystem and reduce outside reliance.