Nvidia can no longer sell its H20 AI chip in China without a special license under new US rules. This change threatens billions in revenue from the Chinese market. To solve this, Nvidia is said to be working with local AI leader DeepSeek to build chips inside China using domestic factories and materials. Reports say the plan will include setting up research teams in China and using SMIC, local memory makers, and packaging partners to make China‑specific chips. Nvidia has not confirmed these plans yet. If true, this could help Nvidia recover its China sales and show how firms adapt to tight export limits.

Nvidia Faces China Export Rules

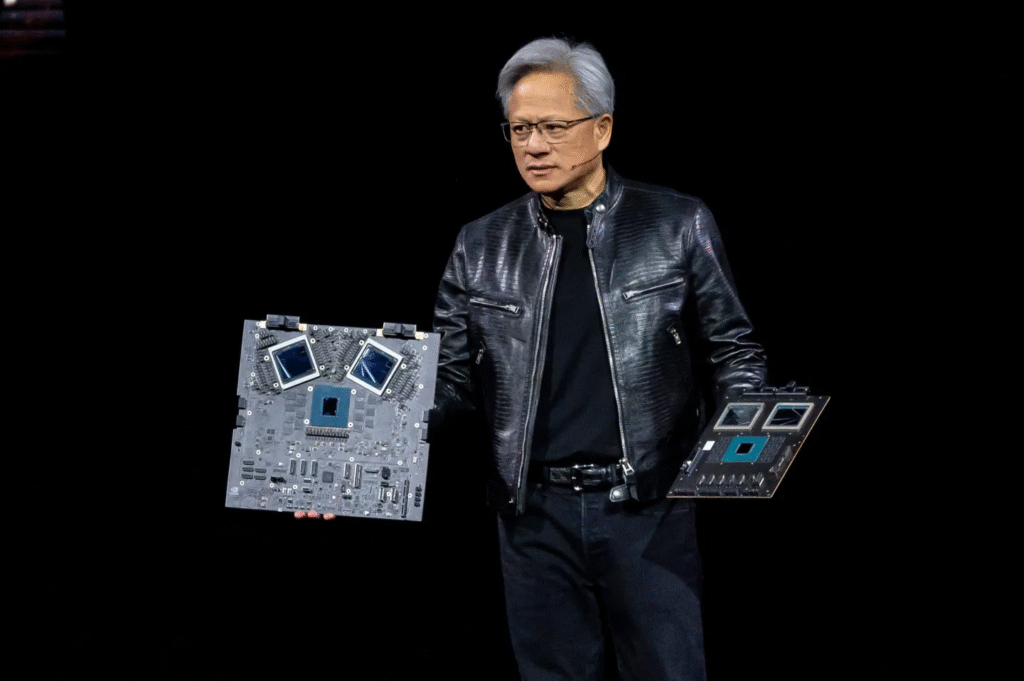

The US government has banned most Nvidia chips from China since 2022 to curb Beijing’s military uses. The H20 chip became subject to a licence requirement this month under the Trump administration. Nvidia warned this could cut its quarterly revenue by as much as $5.5 billion. Nvidia’s chief, Jensen Huang, flew to Beijing to seek solutions with Chinese officials and DeepSeek executives.

A DeepSeek Partnership in China

Reports from Ctee and Wccftech say Nvidia will partner with DeepSeek to co‑design AI chips for the Chinese market. They plan to set up joint research and development centres inside China. These teams will tap into China’s chipmaking ecosystem with SMIC handling the process node and local firms supplying HBM memory. Nvidia hopes this local approach will avoid export curbs and gain support from Chinese regulators.

How the Collaboration Could Work

DeepSeek has shown it can gather Nvidia chips through complex supply chains even under export limits. Nvidia could leverage DeepSeek’s model computing frameworks to tailor chip designs for local AI needs. The joint venture may use China’s major cloud and data centre platforms to test and tune chip performance for popular domestic AI models. This could let Nvidia maintain a strong presence in China despite US export rules.

Impact on Chinese AI Market

China’s AI firms faced a gap when Nvidia chips were restricted. Companies such as Huawei, Moore Threads, and Iluvatar CoreX are racing to fill that gap with homegrown chips. Nvidia’s local partnership could offer domestic developers a high-quality option that retains Nvidia’s CUDA software stack. The move may help Chinese AI startups continue building services without relying on foreign imports.

A Turning Point for Nvidia in China

These plans remain unconfirmed, and Nvidia has not publicly commented on the report. If the partnership goes ahead, it would mark a shift to dual supply chains and show how global firms adapt to export controls. Observers will watch closely to see if locally made Nvidia chips can match global performance and help the company recover its China market share.