President Trump has imposed new tariffs that affect Apple across the world. The new trade measures apply to many nations and impact the company in several ways. Apple must now pay extra duties for goods that enter the United States. The tariffs influence every step of Apple’s operations, from production to pricing. Financial experts warn that these added costs will force the company to raise product prices.

Tariff Effects on the Supply Chain

The new tariffs have changed the way Apple manages its supply chain. Most of the production occurs in one country, and the tariffs now add a cost that Apple cannot ignore. In the past, Apple succeeded in keeping prices stable in the United States by making smart purchases and carefully managing costs. The new tariff plan does not offer the same exemption that the company received during an earlier administration. The tariffs now affect every component that is imported into the United States. This development may force Apple to adjust the price of the iPhone and other products in order to cover the added cost. According to CNBC, the extra costs are significant and spread across the global supply chain.

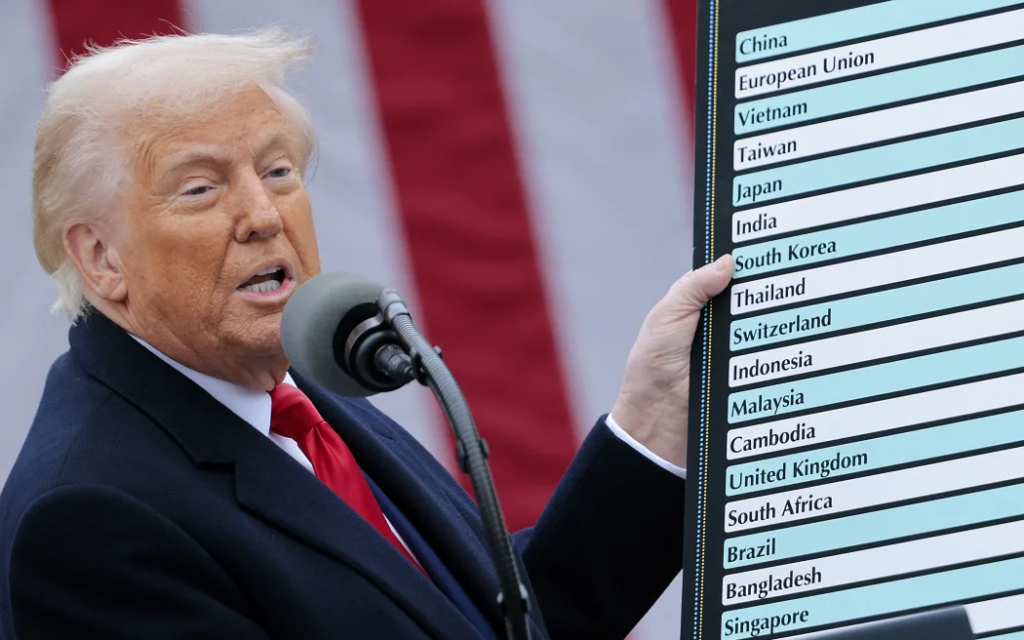

Country-Specific Tariff Impact

Apple sources most of its production from one large country. This country accounts for a large share of the manufacturing of iPhones, iPads, and computers. The tariffs on goods imported from this nation now stand at a high rate. Another nation that assembles some Apple devices now faces a lower tariff rate, but the cost is still substantial. Vietnam has received more investment from Apple to reduce dependence on one nation; however, the new tariffs impose a high duty on items assembled there. Other countries, including those that produce certain computer components, now add to the overall cost when these goods are imported into the United States. The extra tariffs create challenges for Apple when the company tries to negotiate cost management across a diverse supplier network.

Financial Impact and Expert Views

Analysts have studied the new tariffs and their effect on Apple earnings. One expert from a well-known bank predicted that the tariffs could force Apple to raise product prices by up to ten percent. This increase will affect the cost of hardware products in the United States and possibly in other markets. Financial specialists have estimated that every ten percent of tariffs may reduce Apple’s net income in future fiscal years. Some experts also believe that a six percent increase in product selling prices may be necessary to offset the tariff costs. Other analysts have described the new tariff plan as economically harmful for consumers. They expect that American buyers will eventually bear the full cost of the tariffs. The observations from these experts appear in detailed reports by CNBC and AppleInsider.

How the Market Responds

The new tariffs have had an immediate effect on the stock market. Apple shares experienced a steep drop in extended trading. The decline was the largest for any technology firm during the recent trading session. Other companies in the technology sector also saw declines. The market reaction indicates that investors are worried about rising production costs and possible price increases. Financial analysts expect that the changes in the supply chain will create a shift in production patterns. Apple may have to look for ways to lessen the impact by increasing production in countries that offer lower tariff rates. The market requires time to adapt to price elevation as it reveals the complete consequences of the new tariffs.

The company deals with production cost escalation together with sustaining marketable pricing. The company must weigh the decision to absorb some of the cost or pass it on to consumers. This decision will have long-term effects on sales and market confidence. Reliable sources from CNBC provide a detailed account of these challenges. The news shows that global trade decisions can have far-reaching effects on a major company like Apple. The market and consumers will be watching closely as the situation develops.