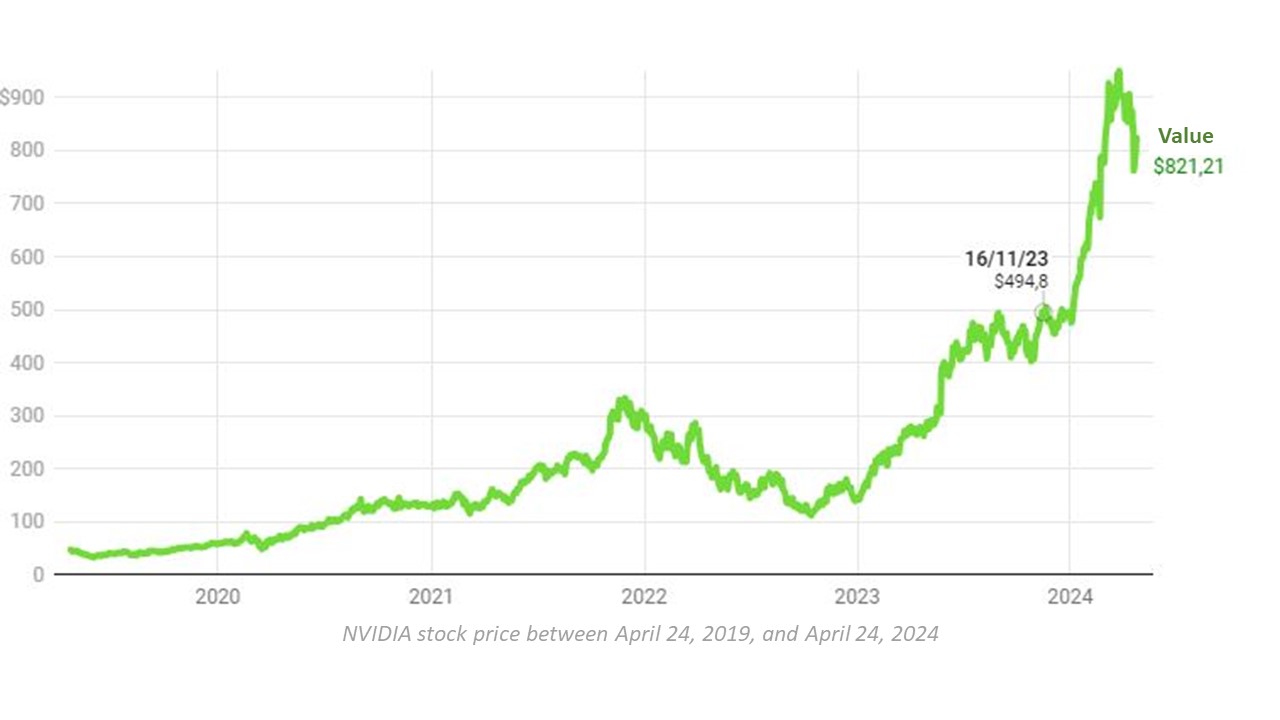

One of the prominent technological protagonists at the beginning of this year has been NVIDIA, owing to its remarkable performance and its steep ascent in the stock market. This ascent led to a 90% growth in the first weeks of 2024, aligning with revenues and, notably, profits that have been exceeding their usual rates.

Please follow us on Facebook and Twitter.

The catalyst, undoubtedly, has been the high anticipation and enthusiasm surrounding the marketing of products related to generative AI, prompting many companies to procure specialized cards from NVIDIA for such tasks. However, this recent correction, while already showing signs of recovery, has sparked potential concerns regarding the company’s future.

The Last Five Years of NVIDIA’s Performance

Design, Not Manufacturing

NVIDIA designs chips that it markets to third parties. Then there’s Apple, which designs the chips it puts in its own products. Microsoft does not currently follow this practice, but it plans to do so by forming an alliance with Intel. This hints at a risk for NVIDIA: the possibility that more and more companies opt to design their own chips instead of purchasing them from suppliers like NVIDIA.

In essence, this risk revolves around the dependency on external manufacturers and the trend among major technology firms to announce their intentions to initiate chip design endeavors. While not a swift or straightforward process, these companies possess the necessary resources and capital to undertake such ventures.

Double Jeopardy

On one hand, companies transitioning away from Microsoft would diminish their reliance on NVIDIA by ceasing to purchase at least a portion of the chips they currently acquire from them. Additionally, they would enhance their capacity for internal innovation and customization of products to meet their specific requirements, akin to Apple’s approach with Apple Silicon, Google with Tensor, or Samsung with Exynos, despite the latter not experiencing their peak performance at present.

Such companies also wield significant control over their supply chains. Given their scale, even the prospect of discovering more competitively priced and marginally better performing options could serve as sufficient motivation to pursue this transition, thereby chipping away at NVIDIA’s market share. It’s worth noting that these purchasers extend beyond corporations to include major global powers such as China and the United States.

The Role of TSMC

Taiwan Semiconductor Manufacturing Company, commonly referred to as TSMC, is the manufacturer of NVIDIA chips—well, at least for the time being. Just a few weeks ago, news surfaced that NVIDIA’s rapid growth had strained TSMC to the extent that it couldn’t keep up with demand.

This development is indicative of the industry’s heavy reliance on TSMC, whose market capitalization surpasses that of giants like Tesla, Samsung, or Tencent. TSMC could leverage this position by tightening contract conditions, a strategy it has already hinted at as its preferred option. This move wouldn’t be unfounded, considering its dominant status as the world’s highest-earning chip manufacturer, boasting a market share exceeding 50%.

And the Competition

Not only those already present in the market, even if they currently stand at a certain distance from NVIDIA, but also those that envision a future where their chips make a substantial leap, potentially rivaling those of Huang’s company. Take, for instance, Samsung, which aims for this with its Mach-1 chip and has initiated a specialized laboratory in general AI to catalyze industry advancement.

Not in the Short Term

In the immediate future, there aren’t many ominous clouds on the horizon for NVIDIA, which will likely maintain its position as the undisputed leader in the specialized AI chip market. However, in the medium term, while risks aren’t something to be taken lightly, they also cannot be overlooked.

NVIDIA could explore various alternatives to navigate these risks. One option could involve reinvesting a portion of the resources acquired during this prosperous phase into constructing their own chip manufacturing plants. Alternatively, they could pursue acquisitions that expedite this process.

Similarly, forging strategic alliances could mitigate their dependence on TSMC and reduce exposure to a potential scenario where manufacturers opt for in-house designs.