Apple Pay Later is now accessible to all users in the US, following its initial release to a limited group of users in March. This feature allows users to divide their Apple Pay purchase costs into four equal payments over a six-week period, all without incurring any interest. Apple first introduced this option in June 2022 during the Worldwide Developers Conference (WWDC).

Apple is currently advertising on its website that Apple Pay Later can be used to defer payments on purchases ranging from $75 to $1000 made through iPhone and iPad devices.

To get started with Apple Pay Later, you need to apply for a loan within the “Wallet” app. During the application process, you’ll be prompted to specify the amount you want to borrow and agree to the terms and conditions of Apple Pay Later. Once your application is approved, you’ll be able to see the “Pay Later” option when making online purchases via Apple Pay on your iPhone and iPad apps.

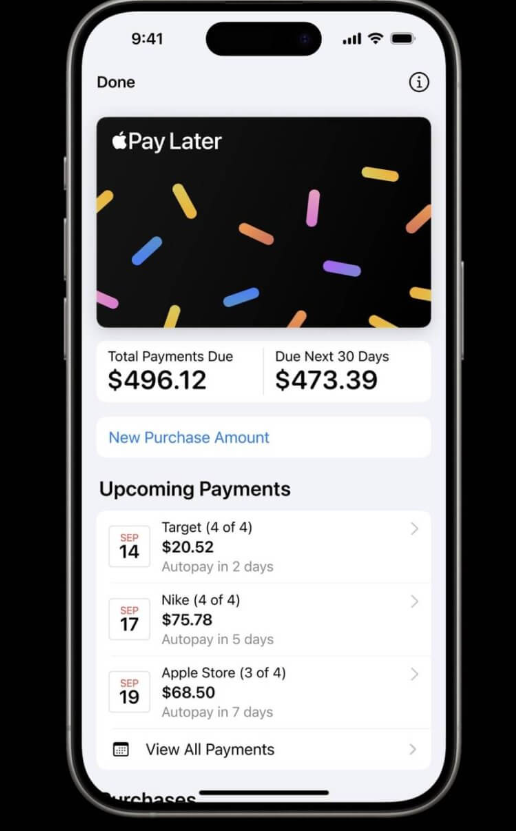

Before making a purchase using Apple Pay Later, you’ll receive a summary of your four new payments, along with details of other upcoming Apple Pay Later payments. You can choose to make payments either automatically or manually. As the payment due date approaches, you will receive reminders and notifications, and you’ll have access to all payment information within the “Wallet” application.

It’s important to note that Apple’s website mentions the possibility of your bank charging a fee if there are insufficient funds in your debit card account to cover the repayment.

With this extensive announcement, Apple Pay Later enters into direct competition with “buy now, pay later” services provided by PayPal, Affirm, Klarna, and numerous other companies in the field.

Related: